By

Leanna Seah

July 12, 2021

Updated

October 9, 2024

Source: Sabine Hortebusch/Shutterstock

Companies around the world were forced to re-evaluate their business strategies in the wake of the Covid-19 pandemic

In March 2020, we had our first gaze into what would become the beginning of our new normal as we went into a global lockdown. The Covid-19 pandemic impacted the world across all levels, throwing a chaotic wrench into our global economy.

The livelihood of millions were altered as international trade came to a standstill. Restricted travel orders, supply chain disruptions, impaired production lines and budgetary shortfalls due to reduced taxes led to a decline in economic activity.

In response to this, businesses across the world were forced to re-evaluate their strategies. Long overdue updates had to be made for the sake of their survival.

Many turned to technology and embraced digitisation in an effort to streamline their operations and reach new and existing customer and client segments.

Companies also began looking towards asset-light business models. Hoping that it that it would be a means of reducing operational costs and increasing their scalability to take on volatile market conditions.

This article aims to take a deeper dive into an asset-light strategy and identifies its role in helping businesses accelerate their growth and international expansion plans.

What does asset-light mean?

Source: Smile Studio/Shutterstock

In a February 2021 webcast poll by Ernst & Young LLP featuring responses of more than 1000 C-suite executives, 31% said that technological shifts and digitisation are key motivators behind their pursuit of an asset-light strategy. Another 25% attributed it to the need to meet customer demand. 21% credited the desire to fuel growth as their reason for going asset-light.

Agility is key in today’s highly competitive market. Businesses need to be swift and nimble enough to respond to constantly evolving marketplace trends if they intend to thrive.

An asset-light strategy allows them to do exactly that. The business model famously adopted by Uber and various tech startups prioritised owning fewer capital assets and instead focuses more on investing in operations.

Companies that adopt an asset-light model typically outsource assets such as customer service, manufacturing, IT, real estate, R&D, industrial machinery and more functions to a network of vendors and service providers. Allowing them to keep their costs low, their operations lean, and their movements agile.

An asset-light model shines as its application can be scaled to businesses of all sizes. Ultimately, it is up business leaders to take the time to review their current business models, operational processes and partnership portfolios.

This will help them determine the changes they must make to sustain their growth and remain competitive in a post-pandemic world.

Key characteristics of an asset-light business model

An asset-heavy, vertically integrated approach offers businesses superior control over company-wide operations and decision making. However, it can be restrictive due to the sheer amount of capital involved, making it hard for them to adapt to changing market conditions.

On the other hand, an asset-light model is defined by the flexibility of its nature but quality-control can be a challenge, especially if a business is unable to find reliable partners for their outsourcing endeavors.

The table below provides us with a comprehensive overview of the defining characteristics of both business models.

| Asset-light | Asset-heavy |

| Less capital expenditure involved in starting a business and to keep it running | Requires large capital expenditure to start a business |

| Focuses on intangible investments such as Intellectual Property, patents and trademarks | Focuses on hard assets such as real estate, machinery and equipment |

| More flexibility to respond to fast-changing market environment | Less flexibility due to significant capital investments |

| Greater financial flexibility due to low costs and lean operations | Have higher margins that can compensate the business for any risks taken |

| Most operations are outsourced to external firms or service providers | Operations are done in-house and therefore, less reliant on suppliers and service providers |

To further make sense of what an asset-light strategy looks like, the list below from Taxguru highlights several defining characteristics frequently adopted by asset-light companies.

A dynamic market environment calls for technologically progressive and responsive businesses

Over the years, we’ve been seeing a gradual shift towards a mindset that prioritises minimalism over abundance.

As consumers, we place greater value in accumulating experiences over objects and are becoming increasingly comfortable with spending our money on services instead of assets.

The same logic can be applied to businesses. More players are beginning to view asset-heavy models as involving large physical assets that can weigh down a company and cause it to be inflexible and slow to respond to change. Or at the very least, investors seem to think so.

Scalability is essential in an evolving marketplace and what often comes hand-in-hand with going asset-light is technology.

Not only will leveraging on the right tech give businesses accurate and detailed insight into their company,, it also allows them to streamline their operations. Thus minimising costs and maximising efficiency.

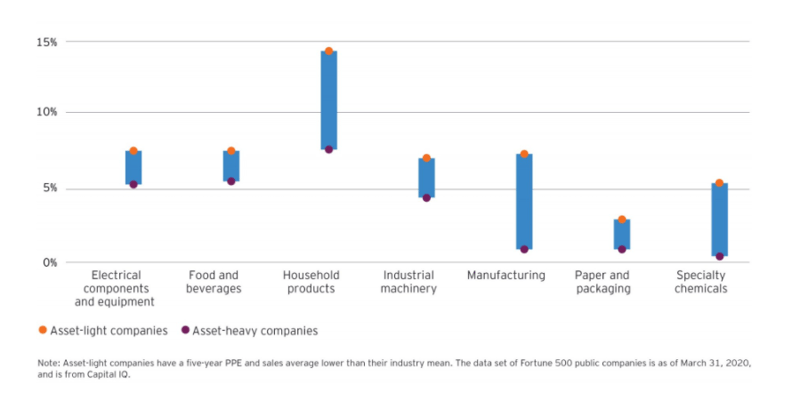

Source: The graph above is from Ernst and Young's research of Fortune 500 companies across various sample sectors. It demonstrates that asset-light companies outperformed their asset-heavy peers by 4% in the last five years of shareholder returns.

Stimulating international growth with an asset-light strategy

Source: ChristianChan/Shutterstock

An asset-light model is more than just a defensive response to uncertain market conditions. Under the right circumstances, it is a sustainable strategy that can provide businesses with the flexibility to adapt and respond to market demands.

It is also especially beneficial to companies with global intent.

The flexible nature of an asset-light business model allows it to expand its reach to new locations with considerable ease.

Through outsourcing, licensing and resource sharing, these businesses have more financial freedom to focus their time and resources on conducting R&D across potential markets, strategising alliances with overseas partners and more.

As their cash is less tied to assets, an asset-light company can reap the benefits of having higher gross margins. They can also leverage their cash reserves on driving innovation through product development and speed up their market entry.

Reducing expenditure on high fixed costs also leaves more capital for cultivating core competencies. This means that businesses can allocate their saved dollars towards investing in the right marketing, training, technology and more.

A move that will strengthen their brand and drive them towards delivering high-quality products and services to their new international markets.

The subject on global expansion cannot be discussed in its entirety without factoring in the growing remote workforce.

With 74% of CFOs deciding to implement remote work as a permanent possibility and savings of up to $22,000 per employee, this is a trend that has been predicted to outlive the pandemic and become part of our new normal.

With various principles that parallel an asset-light model, the latter can be incorporated into a business’ remote work strategy to maximise its success.

This might include automating the onboarding process for new hires to reduce the need for onboarding teams in various locations. Or tapping into diverse talent pools by hiring remote talent in emerging hubs with the help on an Employer of Record. Sparing you the need to set up a physical location while facilitating cost-savings and global team expansion.

How an International Employer of Record can help businesses with an asset-light expansion model

Asset-light companies typically lack traditional corporate infrastructures (i.e. physical offices, payroll teams, HR departments, etc) and are often dispersed across several locations. Thus, working with an Employer of Record (EOR) partner like Airswift can be beneficial on many levels.

An EOR can help companies continue to keep their costs low by shouldering various HR responsibilities such as payroll and tax administration, benefits management, help develop a great employee onboarding and more.

This spares businesses from having to invest their resources into hiring and maintaining internal teams to support these functions, keeping their fixed expenses at a minimum.

Flexibility is a defining feature of an asset-light business model and Airswift provides exactly that. Enter new locations in as little as 72 hours and hire across borders without setting up a physical entity. Scale your business in response to international growth demands as well as manage and pay your global employees compliantly.

Our experts are ready to support you at every step of your growth whilst ensuring maximum efficiency and compliance with international labour regulations.

To learn more about how Airswift can support your company’s international expansion plans, contact us today to set up a consultation and find out more about our Employer of Record services.