By

Leanna Seah

January 12, 2023

Updated

October 29, 2024

Overview

Iraq is a West Asian country with borders to other six countries and the Persian Gulf. The region is what once was called Mesopotamia, one of the firsts civilizations, that gave rise to some of the world's earliest cities and developed the concepts of mathematics, metric and writing systems, law codes, timekeeping and more.

The main strength of Iraq is its oil sector, with the world's fifth-largest oil reserves, at approximately 145 billion barrels. That represents roughly 8% of global reserves in a country with 434,128 square kilometers of area. Despite all that, other industries such as energy, construction and agriculture are growing by the minute. The economy is forecasted to grow at a 5.4% rate per year between 2022 and 2024. With some long term political challenges, Iraq has a Human Development Index (HDI) of 0,674 (121th in the world) a metric that is just under the regional average considering neighboring countries. As far as literacy goes, the rate is improving but is still far from ideal with a 79.75% rate in 2022.

On the other hand, the Gross Domestic Product (GPD) of USD$207.9 billion in 2021 is expected to grow by almost 10 percent by 2027. Iraq also has a big population of English speakers of roughly 11 million people, representing 35% of the country. That shows that Iraq is recovering from past political crises and has the potential to be a great place for organisations to set up operations and hire new employees.

| Capital | Baghdad |

| Languages spoken | Arabic and Kurdish |

| Population size | 41.2 million |

| Payroll frequency | Monthly |

| Currency |

Iraqi Dinar (IQD) |

| VAT |

VAT of 5% on Goods and Services / 20% of mobile recharges and internet / 15% on cars and travel tickets / 10% on tourism related sales / 300% on alcohol and tobacco

|

Payroll and taxes

The main difference about taxes in Iraq is that all income derived from Iraq is subject to tax regardless of the residence of the recipient. Also, income received outside the country by Iraqi and other residents are taxable if they arise from deposits or transactions held in Iraq.

Employer contributions

In Iraq, companies are obliged to contribute to Social Security. In most cases, the rate is 12% of the employee salary directly to cover for health insurance, work injuries and a collective pension. The only exception is for companies in the oil and gas industry that have to contribute 25% of the workers wage.

Apart from the Social Security contribution, there is a withholding tax for non-resident companies of 15% on interest. That means that when a foreign organisation is bound to receive money in Iraq, 15% of the amount is classified as corporate income tax and withheld by the government.

Employee contributions

Regarding employees, there’s only one contribution, which is to Social Security. The rate is 5% of gross salary for all workers.

Personal income tax

As mentioned before, residents and non-residents of Iraq are subject to tax if their income is derived from the country.

All Iraqis are considered residents in order to be taxable. There are two ways for a non-Iraqi to be considered resident for tax purposes:

- Live or reside in Iraq for a total of six months during a tax year

- Live or reside for four consecutive months in the country

Taxable income

All tax residents can claim personal allowances, and these sources of income are considered taxable, unless in a few cases.

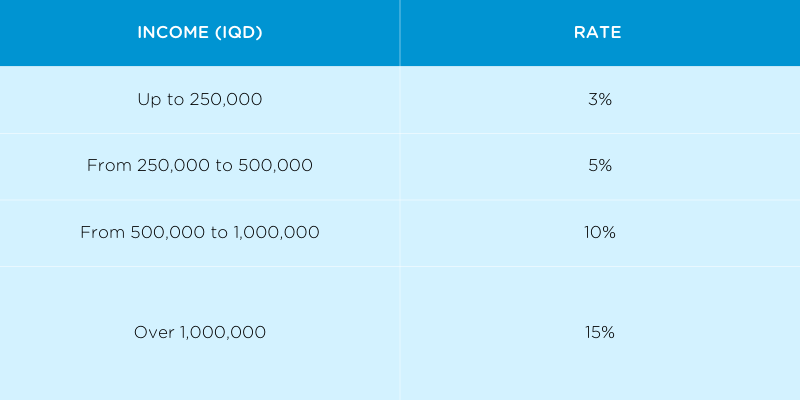

See below for the tax rates applicable to the individual employee’s montly income in Iraq:

Minimum wage

The minimum wage is set at 250,000 IQD monthly which corresponds to 214 USD. This rate is ongoing since it hasn’t been revised since January 1st of 2015. The average salary in Iraq is close to 1.7 million IQD each month, corresponding to an annual salary of 20,8 million IQD which correlates to 14,300.000 USD salary per year.

Working hours

Working hours in Iraq is eight hours per day from Sunday to Thursday.. There’s typically a 30 to 60 minute break for lunch and the employees aren’t supposed to work more than five hours straight. If that happens, the employee is entitled to a resting period of 30 to 60 minutes as well. During Ramadan, the work time is reduced to six hours a day.

Overtime

The regulation for overtime in Iraq depends on the sector . In industrial activities performed in shifts, no more than an hour of overtime is permitted. While performing preparatory and complementary work in industry or with extraordinary work, up to four hours of overtime is allowed. The same time is also for non-industrial activities. All overtime work performed has to be paid with 50% added value to the employee’s hourly rate.- This also covers overtime work performed on days of rest.

Employee benefits

According to employment law in Iraq the major part of employee benefits come from Social Security. It covers work accidents, sicknesses and a collective pension. Apart from that, the other benefits include different kinds of leave the employee can take for specific situations. See them listed and discussed below:

Types of leave available

There are a few types of leave available in Iraq, and they differ from each other.

Annual leave

In Iraq, full-time employees get up to 21 days of paid leave for each year in the company. The exception is for employees that work with hazardous activity or heavy equipment, these types of workers get 30 days of paid leave. After completing five years in the same organization, all workers are entitled to two paid leaves for each year.

Sick leave

Workers are entitled to 30 days of paid sick leave for every year of service, up to 180 days in total. If a sick employee exhausts this period of sick leave and still can’t recover, he will be subject to the Social Security Law. The fund for retirement and social security will refund the employer for the days paid that exceed the 30 days per year of service.

Maternity leave

There’s a 72 day period worth of paid maternity leave. Upon signing the contract there can be some add ons to this time. It depends on the negotiation and the field of action as well.

Paternity leave

There’s no paid paternity leave in Iraq. However, fathers can take unpaid leave up to three days after the birth of a child or to take care of a kid under six years of age.

Bereavement and marriage leave

It’s allowed for workers to take a leave to fulfill their commitments in marriage and in case of a death in the family. However, both of these leaves will be unpaid, as the Iraqi Labor Law doesn’t state the necessity for payment in both these cases.

Public holidays

There are typically 13 public holidays each year in Iraq. Some of the days vary because of the Muslim calendar. The list is:

- New Year's Day - 1 January

- Army Day - 6 January

- Milad Un Nabi (Prophet’s Birthday) - January 24

- Eid al Fitr (End of Ramadan) - 22, 23 and 24 April

- Labour Day - 1 May

- Eid al Adha (Feast of sacrifice) - 29 and 30 June and 1 and 2 July

- Republic Day - 14 July

- Islamic New Year - 19 July

- Ashura - 29 July

- The day after the Arbaeen of Imam Hussein - The 20th day of Safar

- Mawlid (Prophet’s Birthday) - The 12th or the 17th day of Rabiulawal, the third month of the Muslim calendar

- National Iraqi Day - October 3

- Christmas Day - 25 December

The dates marked with an asterisk are Ponto Facultativos which means that they are optional holidays, with the employer making the decision whether to respect the holiday or not.

Attracting talent

Funding an operation in Iraq can be challenging. Being isolated from the rest of the world for so many years, there are many obstacles when the objective is to attract and retain the best talent possible in the country. Especially for companies in industries such as oil, gas and energy, Iraq's highly competitive labour market can demand more from organisations and its human resources departments.

Improve employees' upskilling programs

A lot of international companies entering Iraq have found it difficult to find workers with key skills that are in demand with international business needs.

Skills such as sales, marketing, customer service, performance and time management could be improved. Therefore, providing upskilling courses and programs that enable workers to improve and develop in these areas can be a game changer for retaining talent as well as improving employee engagement.

When people feel that they are an asset to the company, they’re far more likely to stay in their jobs.

Have a great management team

It’s a fact that people tend to leave managers, not jobs. Having a good manager can make a difference in retaining top talent in your business.

A great way to retain your best talent is by equipping employees in managerial positions with effective leadership skills so that they can support their teams and help them thrive in challenging situations.

Good listening abilities, selflessness, practicality and strong organisational skills are all qualities the workforce values. Investing in training and feedback programs to help managers work on developing these skills and more can help to produce strong business leaders with the capacity to set clear expectations and motivate employees within the business.

Place international opportunities front and center

A great way to attract new candidates is to provide them with career development opportunities. This includes the option to work in a new country, participate in overseas training programs or be a part of international remote teams.

Participating in cross-cultural exchanges and working with individuals from different backgrounds are enriching experiences that many employees value. Companies that can offer these opportunities must realise that these are some of their best assets in attracting a young and adventurous workforce and will stand to benefit by using them as part of their recruitment marketing.

Termination and probation

Probation period

The probationary period works as a trial for organisations to get to know the candidates and analyse their performance and abilities. This time can go up to three months, but no more than that. The duration has to be specified in the contract, and after this period, the employee is signed on to the business as a full-time worker.

Termination

The possible situations for termination in Iraq are the following:

- Mutual agreement between employer and employee

- Expiration of contract (in cases where there are specific dates)

- The employee wants to pursue another job opportunity

- More than six months of incapacity in case of illness

- In the case of disabilities that affect the workers' performance

- The company is at risk of bankruptcy

Workers can’t be terminated simply for bad performance. If someone is underperforming, the business must first provide them with a written warning.

However, if the behaviour continues for a period of 30 days or more after the warning is issued, the contract may be unilaterally terminated. It’s also required for a termination notice to be provided at least 30 days prior to the termination date.

If that doesn’t happen, the employee must receive payment for the days that would have been covered during this period.

If the employee being terminated is over 60 or 55 years of age (depending on whether they're male or female) and has at least 20 years of service, they are entitled to retirement.

What are my options for hiring?

Interested in expanding your company into Iraq? Airswift can help with that!

We can assist with the best hiring practices, navigating labour law, taxes and payroll, legal counselling, arranging the right permits and many other tasks.

We are proud to offer our clients our expertise in protecting their businesses from unnecessary risks and freeing up more time and resources so that they can concentrate on their companies' duties, expansion and prospects.

We want to help your company in attracting the best candidates in Iraq. We are acquainted with a wide range of industries so that we can find the talent that best fits your needs in the fastest way possible.

Talent acquisition

If you need to hire contract workers for short-term projects in more flexible ways, we can also assist with that. Our database of highly qualified contractors is the perfect place for your business to find the best talent there is.

If your company is looking for permanent employees, we offer a service provided by a specialised recruitment team that’s eager to help. Count on us in Iraq to find the best talent possible!

Airswift is committed to finding the workers that are suited to your needs. You can rely on us to speed up your hiring processes and retain your talent.

Employer of record

If what your company needs is to hire in Iraq without setting up a local office, Airswift can do that for you!

We can act as an Employer of Record in Iraq in order to hire in the workforce that you need as fast as possible and get your company up and running. Airswift will take care of everything! From permits to onboarding, taxes and payroll, benefits management and much more!

*Although the information provided has been produced from sources believed to be reliable, no warranty, express or implied, is made regarding the accuracy, adequacy, completeness, legality or reliability of any information. For the latest information and specific queries regarding particular cases, please contact our team.